AlchemyAI Ensemble Intelligence

AlchemyAI is a proprietary intelligence stack built on dedicated AI hardware boxes that collaborate in distributed compute processing. It blends ARIMA, TimeGPT, MLTFT, and proprietary market microstructure signals while executing the patented "System and Method for Cryptocurrency Trading" (U.S. Patent No. US 12,106,372 B2). This is a unique and powerful approach, not just a combination of other models.

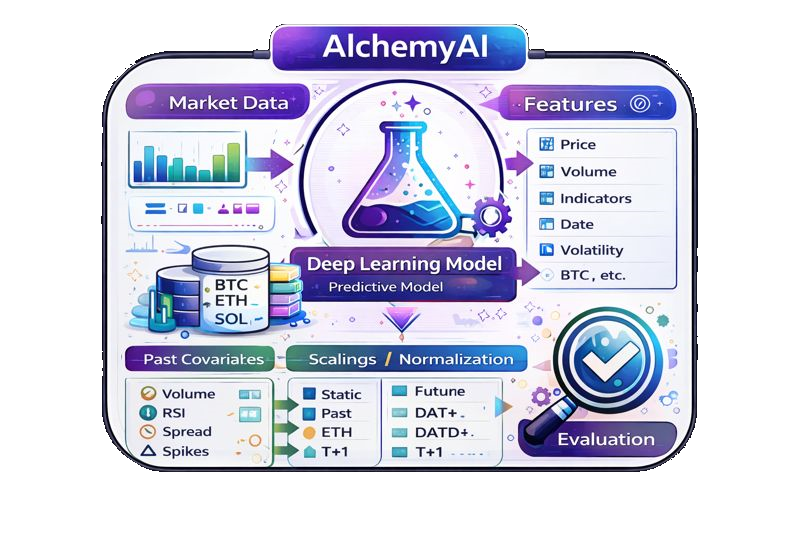

How AlchemyAI Works

AlchemyAI treats each model as a specialist. Statistical baselines provide stability, transformer models supply long range structure, and real time liquidity signals track microstructure drift. A mesh of dedicated AI boxes runs the scoring graph in parallel, coordinating low latency signal fusion with deterministic risk gates.

The output is a risk aligned score rather than a raw forecast. That score is constrained by capital limits, drawdown budgets, and exchange specific execution rules defined in the patented "System and Method for Cryptocurrency Trading" (U.S. Patent No. US 12,106,372 B2). The result is a decision grade that is ready for automated action.

- Distributed AI boxes that coordinate signal fusion and scoring.

- Meta learner that combines model outputs with confidence weights.

- Regime classification to reweight models during volatility shifts.

- Risk control layers to enforce exposure and drawdown limits.

- Execution feedback to retrain weights using realized slippage.

Collect Signals

Ingest forecasts, volatility, order book metrics, and cross asset correlations.

Weight and Blend

Apply adaptive weights based on model performance and regime score.

Risk Gate

Cap exposure, enforce drawdown budgets, and sanitize for execution friction.

Feedback Loop

Measure realized outcomes and update weights for the next cycle.

Core Equations

The ensemble blends forecasts into a risk aware decision score rather than a single point estimate. Fluid dynamics equations inform our flow based intuition for liquidity and momentum propagation.

Where AlchemyAI Fits

- Robust to noise by blending complementary models.

- Risk aware outputs aligned with portfolio controls.

- Execution feedback closes the loop with real outcomes.

- Requires reliable performance tracking for stable weights.

- More complex to debug than single model outputs.

- Needs strong data quality to avoid signal leakage.

AlchemyAI is the production decision layer that integrates patented workflows, distributed hardware scoring, and multi model intelligence into a single trade ready score.